lake county tax bill due dates

Physical Address 18 N County Street Waukegan IL 60085. Postmarks from private mailing machines are no longer.

Lake County To Extend Emergency Rental Assistance Program Lady Lake

Due Dates for Property Taxes.

. Taxes paid online will be charged to your credit card within 24 hours. Lake County IL 18 N County Street Waukegan IL 60085 Phone. PAYMENTS WILL NO LONGER BE PROCESSED WITHOUT THE 5 FEE.

Tax bills will be mailed. Current property tax due dates are. You will receive a statement with upcoming due dates in the Spring.

SECOND INSTALLMENT OF REAL PROPERTY TAXES ARE DUE FEBRUARY 1 2023 AND WILL BE DELINQUENT IF NOT PAID BY APRIL 10 2023. The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. Dear Taxpayer and Resident.

May 31st and November 30th. Skip to Main Content. Payment shall be made no later than December 31.

Tax Year 2020 First Installment Due Date. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. When this office receives that data we will be able to print and mail the bills.

Tuesday March 2 2021 Late Payment Interest Waived through Monday May 3 2021. No discount shall be allowed after September 30. Friday October 1 2021.

847-377-2000 Contact Us Parking and Directions. Mailed payments must be postmarked no later than DECEMBER 12 2022. All dates are subject to change.

Ad Pay Your County of Lake Bill Online with doxo - The Easiest Way to Pay. The assessors offices are working in the 2021 year currently. 8 AM 430 PM MONDAY FRIDAY.

Mobile home due date. To ensure correct posting of your tax payment please call the tax office to get the current and accurate balance due at 541-947-6000. Tax Year 2020 Second Installment Due Date.

One-quarter of the total estimated taxes plus one-half of any adjustment pursuant to a determination of actual tax liability discounted 3. Property tax payments are made to your county treasurer. Notice Of Real Estate Tax Due Dates.

The collection begins on November 1st for the current tax year of January through December. Main Street Crown Point IN 46307 Phone. Check out your options for paying your property tax bill.

Tuesday March 1 2022. Check out how to pay in person for your property tax bill. THE LAKE COUNTY TREASURERS OFFICE IS OPEN TO THE GENERAL PUBLIC.

Real estate taxes are due in February and July of each year. Lake County IL 18 N County Street Waukegan IL 60085 Phone. Office of the Lake County Tax Collector 320 West Main Street Administrative Office 2nd Floor Suite B Tavares Florida 32778 Phone.

Payments that are mailed must have a postmark of Wednesday February 1 5 202 3 or before by the United States Postal Service only. IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL. Access important payment information regarding payment options and payment due dates for property taxes.

TAXPAYERS CAN CONTINUE USING THE EXISTING DROP BOX AS AN ALTERNATIVE TO COMING IN NO CASH IN THERE PLEASE. Tax Year 2021 First Installment Due Date. Due dates for property taxes are as follows.

November 30th and May 31st. Payment shall be made no later than September 30. Check out your options for paying your property tax bill.

Lake County IL 18 N County Street Waukegan IL 60085 Phone. ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST INCLUDE 5 FOR A DUPLICATE BILL FEE PER PARCEL. Skip to Main Content.

In accordance with 2017-21 Laws of Florida 119 Florida Statutes. NOTICE FIRST INSTALLMENT OF REAL PROPERTY TAXES ARE DUE NOVEMBER 1 2022 AND WILL BE DELINQUENT IF NOT PAID BY DECEMBER 12 2022. It can take up to 4 business days for your tax record to be updated with the tax office.

The drop box is only available from when the bills are mailed through the 2nd installment due date. Notice is hereby given that Real Estate Taxes for the First Half of 2022 are due and payable on or before Wednesday February 15 2023. Real Estate May 15th first half for all real estate October 15th second half for commercial and residential property November 15th second half for agricultural property Personal Property May 15th in full Mobile Homes August 31st first half November 15th second half.

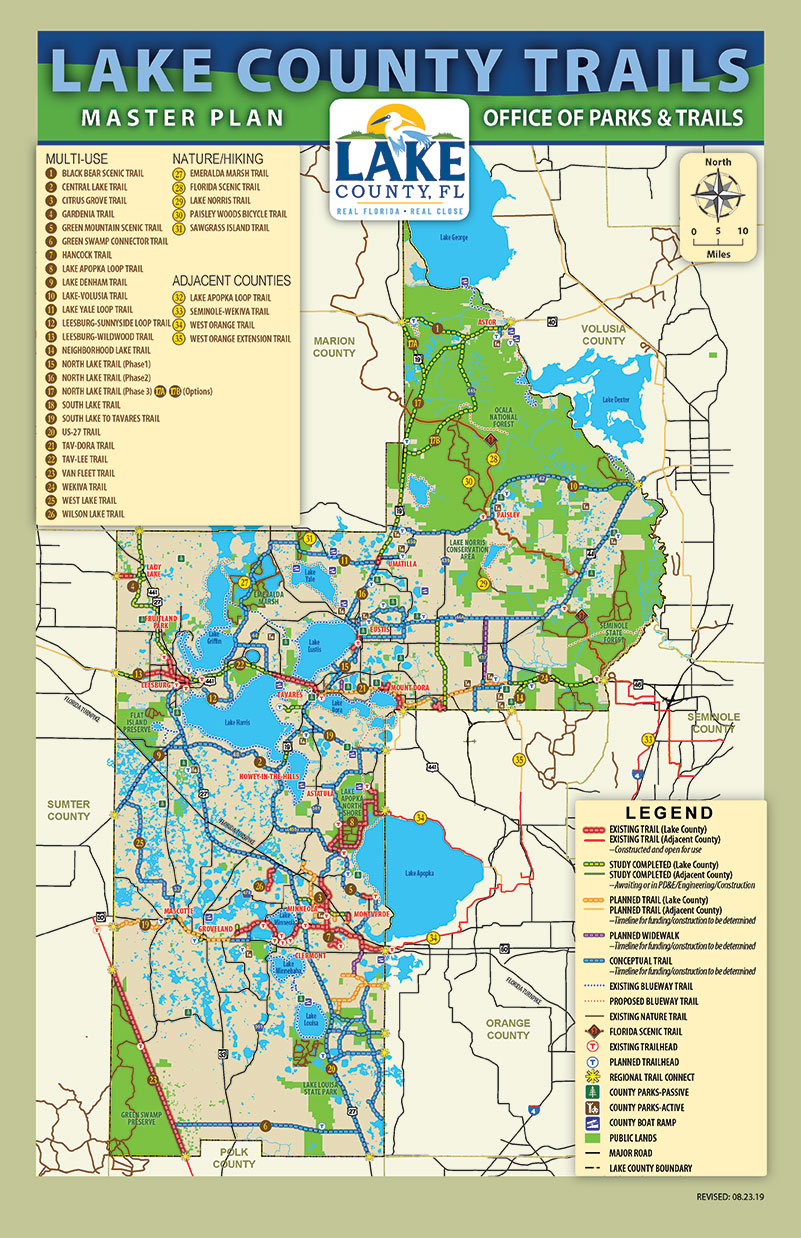

Property taxes are due twice a year. These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office.

Clerkpay Online Court Payments

Property Taxes Lake County Tax Collector

American Rescue Plan Act Lake County Il

Lake County Assessors Clash Over Property Value Hikes

Parking And Directions Lake County Il

Salt Lake County Government Facebook

Property Taxes Lake County Tax Collector

Birth Certificates Florida Department Of Health In Lake

Property Tax Search Taxsys Lake County Tax Collector