nh tax return calculator

New Hampshire NH State Income Taxes. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income.

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

For comparison the median home value in New Hampshire is 24970000.

. The New Hampshire tax calculator is updated for the 202223 tax year. WPRO-12 In addition to your current IRS tax withholding which is most likely based on your latest W-4 and based on your entries we suggest you withhold this additional tax amount in order to balance or reduce the taxes owed with your 2022 Tax Return. TAX DAY NOW MAY 17th - There are -432 days left until taxes are due.

Ad See How Long It Could Take Your 2021 State Tax Refund. Being taxed for FICA purposes. Figure out your filing status.

Low Income Housing Tax Credit. Calculating your New Hampshire state income tax is similar to the steps we listed on our Federal paycheck calculator. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price.

The NH Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NHS. New Hampshire Income Tax Calculator 2021. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Take the purchase price of the property and multiply by 15. The Current Use Board is proposing to readopt with Amendment Cub 30503 Cub 30504 -Assessment Ranges for Forest Land Categories With and Without. The New Hampshire Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Hampshire State Income Tax Rates and Thresholds in 2022.

Start filing your tax return now. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. It is one of 9 states which do not have state income tax.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Please consider there is no state income tax in New Hampshire.

The New Hampshire income tax calculator is designed to provide a salary example with salary deductions made in. While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. This tax is only paid on income from these sources that is 2400 or more for single filers and 4800 or greater for joint filers. Before the official 2022 New Hampshire income tax rates are released provisional 2022 tax rates are based on New Hampshires 2021 income tax brackets.

New Hampshire does not tax individuals earned income so you are not required to file an individual New Hampshire tax return. Census Bureau Number of cities that have local income taxes. Deductions and personal exemptions are taken into account but some state-specific deductions and tax credit programs may not be accounted for.

Based on the data entered and the tax refund amount shown at WPRO-10 above we suggest you reduce your tax withholding to. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. - FICA Social Security and Medicare.

This calculator is based upon the State of New Hampshires Department of Revenue. Details of the personal income tax rates used in the 2022 New Hampshire State Calculator are published. - New Hampshire State Tax.

To use our New Hampshire Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20.

The 2022 state personal income tax brackets are. Concord NH 03301 P 603-226-2170 F 603-226-2816. Timber Gravel Tax.

If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. New Hampshire Salary Tax Calculator for the Tax Year 202223 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223. You might initially assume that if you have no major investments like stocks and bonds that.

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. New Hampshire income tax rate. Your average tax rate is.

0 5 tax on interest and dividends Median household income. Of that amount being taxed as federal tax. Use our interactive calculator below to gain a better understanding of how your business can maximize its support of local community projects through the CDFA Tax Credit Program.

Real Estate Transfer Tax. As such New Hampshire Interest Dividends and Business Tax Business Profits Tax and Business Enterprise Tax returns that are due on Friday April 15 2022 will be due on Monday April 18 2022. Our free online New Hampshire sales tax calculator calculates exact sales tax by state county city or ZIP code.

The state only taxes interest and dividends at 5 on residents and fiduciaries whose gross interest and dividends income from all sources exceeds 2400 annually 4800 for joint.

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

Here S The Average Irs Tax Refund Amount By State

The Irs Has Released Some Important Updates That All Mandated Aca Reporters Should Know About Health Insurance Plans Health Insurance Coverage Business Rules

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Virtual Remote Tax Preparation Services H R Block

2021 Taxes A Comprehensive Guide To Filing Money

Taxes 2022 Important Changes To Know For This Year S Tax Season

Calculator Financial Reporting Cookies Polymer Clay Crafts Sugar Cookies Decorated Cookie Decorating

How To Easily Amend Tax Return Before Irs Catches Your Mistakes Internal Revenue Code Simplified

Tax Season 2022 When Can You File Taxes With Irs In 2022 Money

4 Tax Tips Every Small Business Needs To Know Bookkeeping Services Startup Funding Business

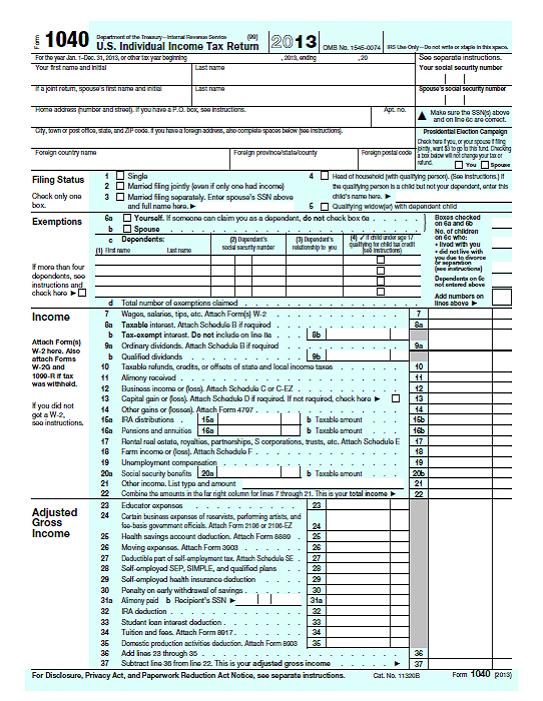

2013 Federal Tax Refunds Waiting For Non Filers

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets

What Non U S Citizens Should Know About Filing Taxes Mybanktracker