vermont state tax withholding

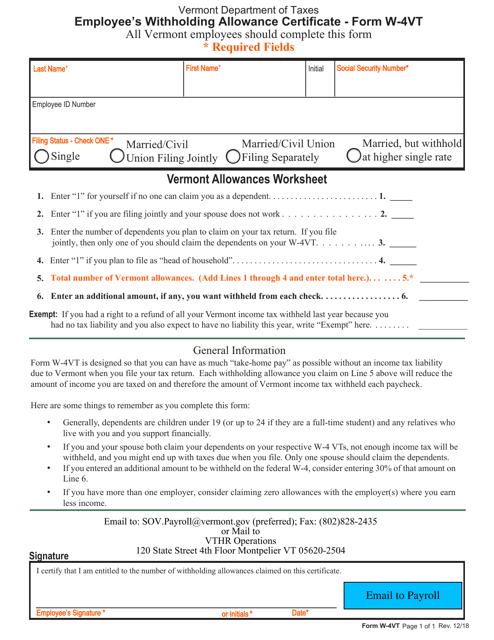

W-4VT Employees Withholding Allowance Certificate. No action on the part of the employee or the personnel office is necessary.

Find an existing Withholding Account Number.

. By Tax Type. The annual amount per exemption has increased from 4050 to 4250. 2022 Income Tax Withholding Instructions.

The Single Head of Household and Married tax tables has changed. The withholding is based on both the deferred payment and any income that may be derived from the deferred compensation. The Amount of Vermont Tax Withholding Should Be.

The income tax withholding formula on supplemental wages for the State of Vermont includes the following changes. File Scheduled Withholding Tax Payments and Returns. No action on the part of the employee or the personnel office is necessary.

The gov means its official. The income tax withholding for the State of Vermont includes the following changes. If Federal exemptions were used and there are additional withholdings proceed to step 8.

Semiweekly monthly or quarterly. If additional Federal tax was withheld multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly Vermont tax withholding. Ashlynn Doyon at treasurersofficevermontgov.

The annual amount per exemption has increased from 4250 to 4350. State government websites often end in gov or mil. An employee is paid 1800 each week.

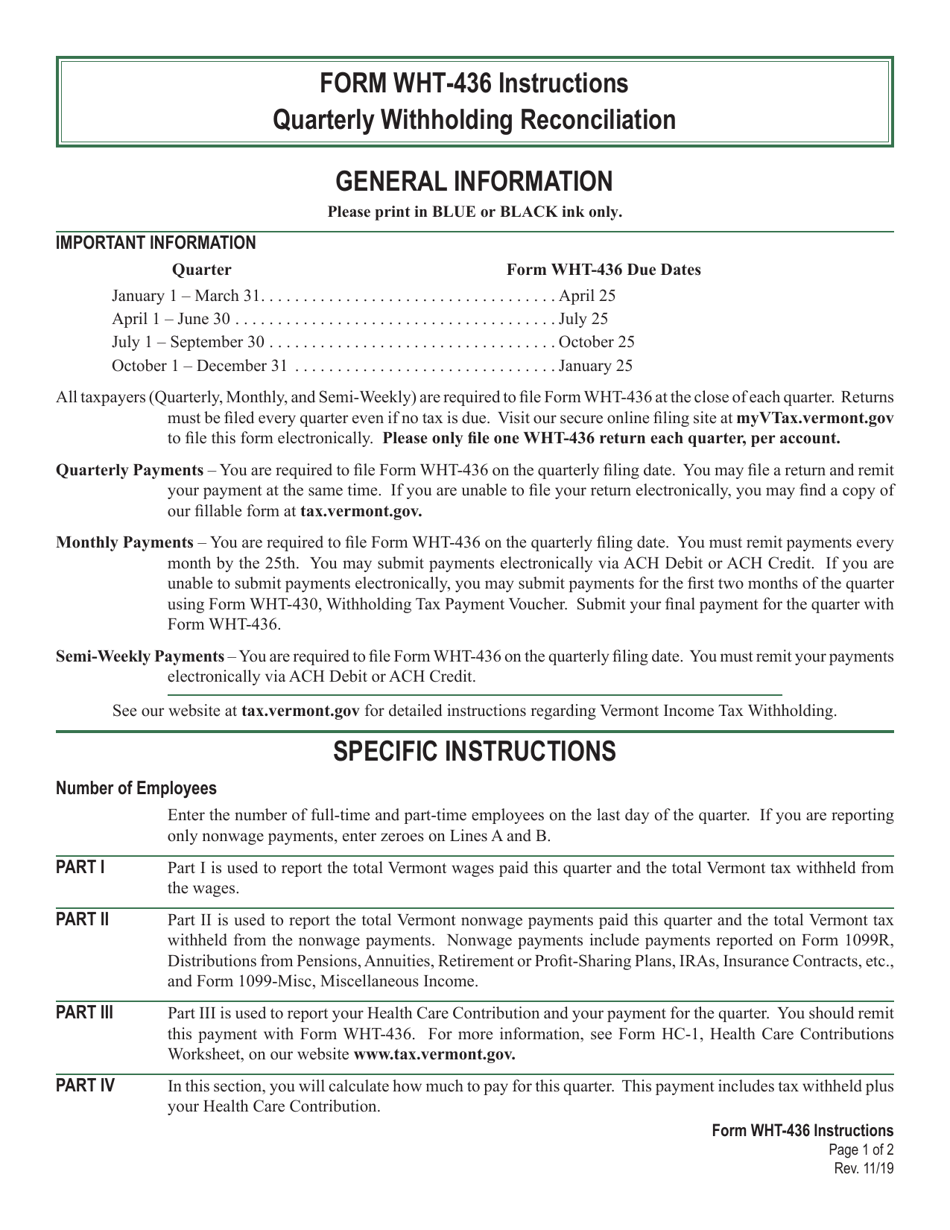

Sign Up for myVTax. There are four tax brackets that vary based on income level and filing status. Your payment schedule ultimately will depend on the average amount you withhhold from employee wages over time.

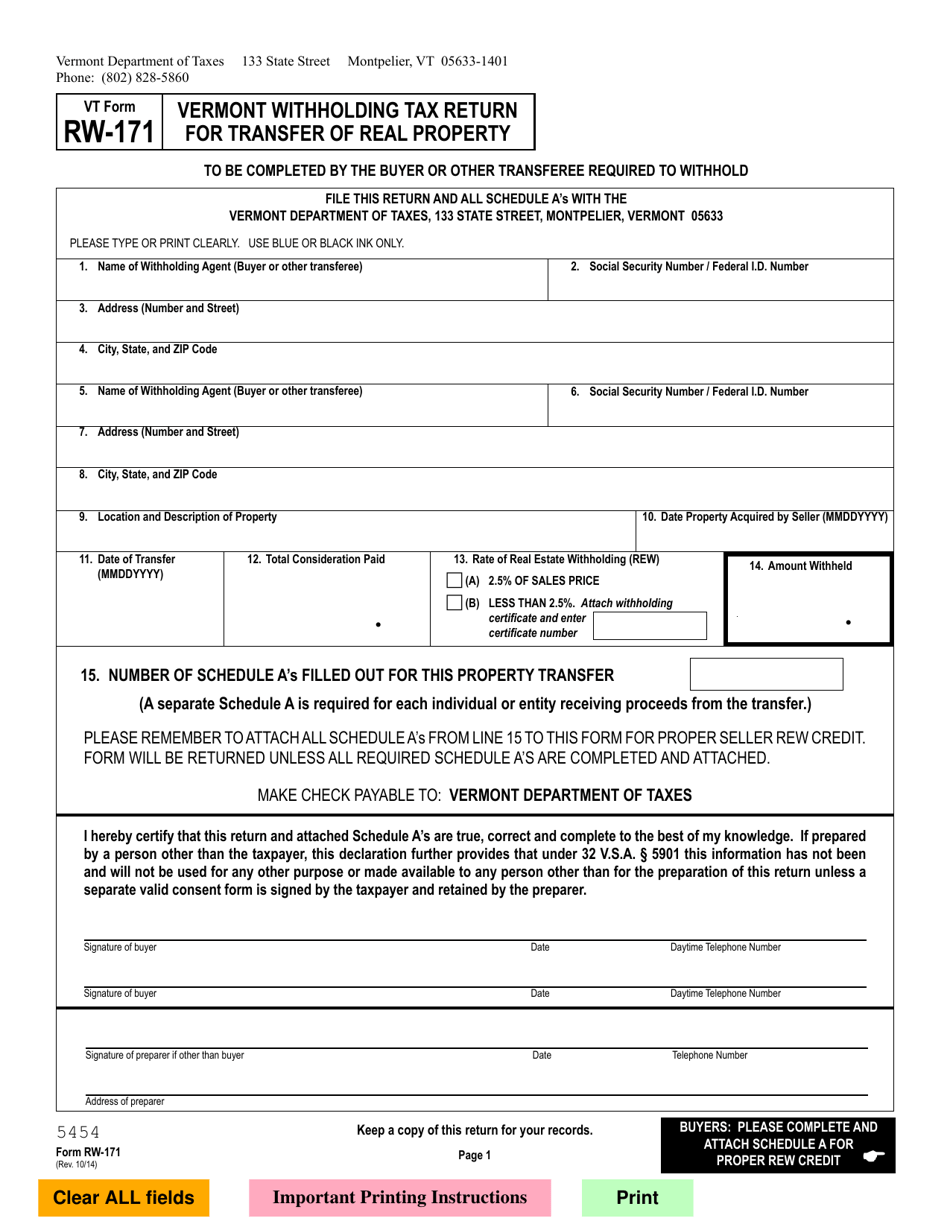

No action on the part of the employee or the personnel office is necessary. Except as otherwise provided in this section in the case of any sale or exchange of real property located in Vermont by a nonresident of Vermont the transferee shall be required to withhold and transmit to the Commissioner within 30 days of such sale or transfer a withholding tax equal to 2 12 percent of the consideration paid for the transfer. Office of the State Treasurer 109 State Street Montpelier Vermont 05609 Main Phone.

Reporting and Remitting Vermont Income Tax Withheld If you pay wages or make payments to Vermont income. If the Amount of Taxable Income Is. Authorize Zenefitsas a third-partyagent to file and pay taxes.

Vermont Department of Taxes Withholding Account Number. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. Single or Head of Household.

If Federal exemptions were used and there are additional Federal withholdings proceed to step 8. The Single or Head of Household and Married income tax withholding tables have changed. PUBLIC INFORMATION REQUESTS TO.

802 828-2301 Toll Free. In Vermont there are three main payment schedules for withholding taxes. Vermont withholding is 50938392 x 00660 554 554 4539 5093 Because 162692 falls between 1543 and 3463 the tax is computed as 4539 plus 660 of the amount over 1543.

PA-1 Special Power of Attorney. The states top tax rate is 875 but it only applies to single filers making more than 206950 and joint filers. WHT99999999WHT8 digits Apply online at the VT Secretary of States Online Business Service Centerto receive a Withholding Account Number within 5-7days.

Tax Rates and Charts. Vermonts tax rates are among the highest in the country. Tax Withholding Table.

Apply the taxable income computed in step 5 to the following table to determine the annual Vermont tax withholding. The annual amount per allowance has changed from 4350 to 4400. Vermont School District Codes.

The Single and Married income tax withholdings will increase for the State of Vermont as a result of changes to the formula for tax year 2017. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. Department of taxes.

Before sharing sensitive information make sure youre on a state government site. Her W-4VT form claims two withholding allowances and married status. The income tax withholding for the State of Vermont includes the following changes.

Tax Formula Withholding Formula Effective Pay Period 06 2017. 2017 and 2018 Income Tax Withholding Instructions Tables and Charts. B-2 Notice of Change.

If Federal exemptions were used and there are additional withholdings proceed to step 8. The more you withhold the more frequently youll need to make withholding tax payments. Respond to Correspondence.

IN-111 Vermont Income Tax Return. Plan the correct withholding rate is 6 of the deferred payment. No action on the part of the employee or the personnel office is necessary.

The Single Head of Household and Married annual income tax withholding tables have changed. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. Click Here - For Public Records Database.

This document is designed to provide you with an overview of the Vermont The Vermont Income Tax Withholding is computed in the same manner as federal withholding tax by using the Vermont withholding tables or wage. Fact Sheets and Guides. If additional Federal tax was withheld multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly Vermont tax withholding.

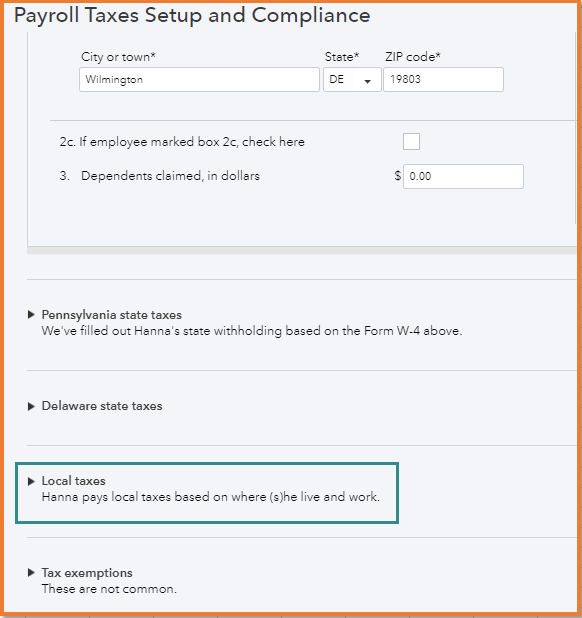

I Am A Pa Employer And I Am Unableto Set Up Local

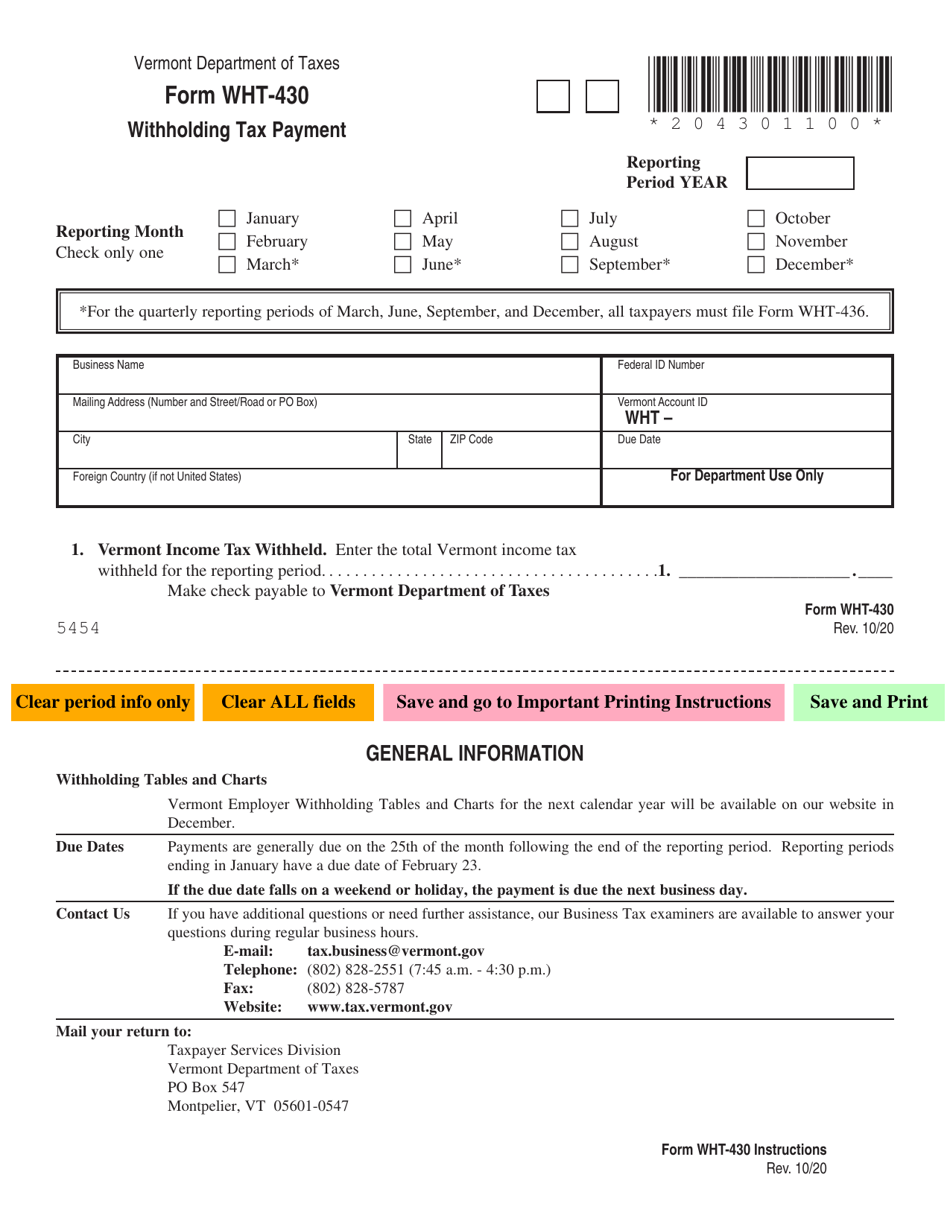

Vt Form Wht 430 Download Fillable Pdf Or Fill Online Withholding Tax Payment Vermont Templateroller

State W 4 Form Detailed Withholding Forms By State Chart

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

State W 4 Form Detailed Withholding Forms By State Chart

Vt Form Rw 171 Download Fillable Pdf Or Fill Online Vermont Withholding Tax Return For Transfer Of Real Property Vermont Templateroller

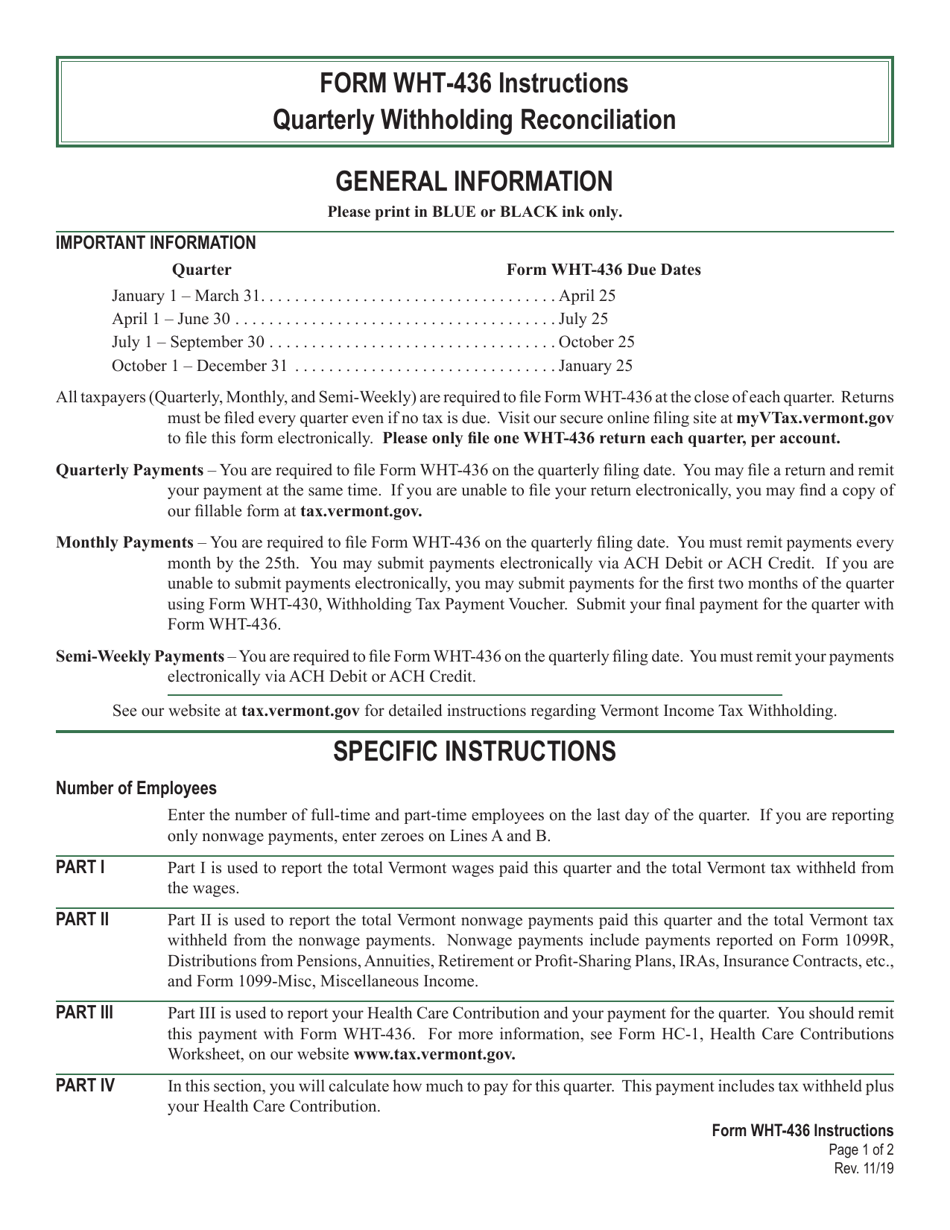

Download Instructions For Vt Form Wht 436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Why Itr Filing Is Important And What Is Tds Income Tax Income Tax Return Tax Return